TAXES

Little Company Nigeria Limited are proud TAX contributors. All Jollof by Jara bills include Consumption Tax at 5% (LIRS) and 7.5% VAT (FIRS), as standard (mandatory). Service Charge is added add 2.5%, and is optional.

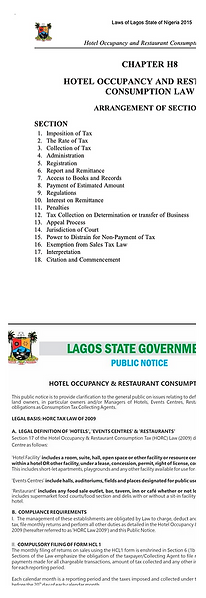

HOTEL OCCUPANCY AND RESTAURANT CONSUMPTION TAX LAW

Effective 22nd June 2009, Lagos State Government has imposed a 5% consumption tax on all purchases of goods and services sold to consumers in any restaurant, hotel, event centre and entertainment venue (bars, clubs, lounges).

The owner of the restaurant, hotel, event centre, etc is obligated to register with the Lagos State Internal Revenue Service (LIRS) as a collecting agent. The collecting agent must charge and collect 5% consumption tax on all consumables and personal services and remit to the LIRS monthly.

Little Company Nigeria Ltd., the owners of Jara Beach Resort are registered with the LIRS as a collecting agent and must charge 5% consumption tax. All customers of the services provided by Little Company Nigeria Ltd. are obligated to pay the 5% consumption tax.

You'll find copies of the LIRS Public Notice from March 2021 on Consumption Tax and the Hotel Occupancy and Restaurant Consumption Law in PDFs right / below.

VALUE ADDED TAX

Value Added Tax is a consumption tax on goods and services. The current rate of Value Added Tax (VAT) in Nigeria is 7.5%. The Federal Inland Revenue Service (FIRS) is the agency of the Federal Government that administers VAT.

Little Company Nigeria Ltd., the owner of Jara Beach Resort is registered with the Federal Inland Revenue Service. Little Company Nigeria Ltd must charge 7.5% VAT on services rendered to customers. The VAT is remitted monthly to the FIRS.

Section 2 (b) (i) and (ii) of the VAT Act states:

“(b) in respect of a service –

(i) the service is rendered in Nigeria by a person physically present in Nigeria at the time of providing the service

(ii) the service is provided to and consumed by a person in Nigeria, regardless of whether the service is rendered within or outside Nigeria or whether or not the legal or contractual obligation to render such service rests on person within or outside Nigeria.”

Section 2A (1) states:

(1) “For the purposes of this Act, supply shall be deemed to take place at the time an invoice or receipt is issued by the supplier, or payment of consideration is due to, or received by the supplier in respect of that supply, whichever occurs first.

This means that Little Company Nigeria Ltd. must charge VAT on all supply of goods and services except those specifically listed as exempt in the VAT Act.

Any customer who requires evidence of the remittance of the VAT paid over to Little Company Nigeria Ltd. can make a request. Our Tax Consultant will liaise with the customer and make the relevant evidence and documents available.